Three Questions to Confirm if Your Payment Partner is Healthy For Your Business

In our last post, I discussed how we borrowed an early detection strategy from the healthcare industry to create a Payment Health Screening Questionnaire. The screening is designed to identify risk factors that may lead to serious business conditions such as painful overpayment, weak support and high risk security.

Part one of the assessment addressed payment health from a cost perspective. Today, we’ll focus on the well-being of the service you receive from your payment services provider.

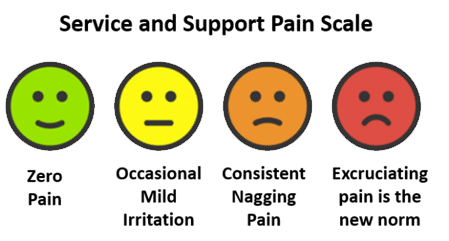

Service Pain Scale

Poor or inconsistent service appears to be a growing ailment that many merchants experience on a regular basis. It ranges from causing mild discomfort all the way up to excruciating pain, depending on your situation and the issue you need to resolve.

Regardless of where you are on the pain scale at this moment, it’s important to periodically assess your service to stay on top of the warning signs indicating that support from your processor is on the decline.

The following three questions will help you make that assessment.

1. Are you getting the same level of service from your provider that your customers expect from you?

Customers are your lifeblood and delivering a consistent quality experience is a top priority for most businesses. Your payment partner should feel the exact same about you.

Symptoms that you’re not getting the service you deserve include:

- Difficulty getting the right person on the phone to help you

- Sluggish responses to your questions or issues

- Inflexibility with solutions to solve your problems

- No preventive maintenance to ensure you’re getting the best prices

- Nagging feeling that you’re just not big enough to be important

Any of these symptoms are definite early warning signs that can lead to big trouble for your payment program and your business. Having all symptoms puts you squarely at the top end of the pain scale and in need of a cure as soon as possible.

The remedy we have found most successful is to provide the payments solution of a mega-company while keeping the service values and pride of a family-owned business. It’s worked for 20 years, and it will continue to work for 20 more and beyond.

2. Do you have a dedicated service contact you can call with questions or issues?

Not having a dedicated person to call when you need help is like trusting your healthcare to a pool of doctors. You don’t know which doctor you’ll get when you need one, and whoever it is, likely will not be familiar with you or your history, which means you’ll have to acquaint that person with your medical past before your present condition can be treated. Sounds ludicrous, right?

Wind River agrees. We believe in committing a dedicated service rep to every single customer. Your rep will actually spend time to get to know you and your business so your questions and issues can get resolved as quickly as possible.

3. Is your business earned every month without a contract?

Do you stay with your provider because you want to or because you have to? I have a friend who is in the middle of a bundled package with a major phone / internet / TV service provider. She’s terribly unhappy and rues the day she decided to sign on the dotted line. Rest assured, as soon as that contract is over, she’s switching her service.

Think about your own customers for a minute. Would you prefer to have customers who stay only because of a contract, or would you prefer customers who stay because they want to do business with you? Most companies choose the latter. Your payment processor should choose it as well.

Just to clarify, I’m not anti-contract. There is absolutely nothing wrong with having a contract in place as long as that piece of paper is not the sole reason for a customer sticking around. Your processor should be focused on delivering exceptional experiences at every touch point so you’ll want to stay – with or without a signed piece of paper.

What Your Answers Indicate

![]() If you answer “yes” to all of the questions above – congratulations, you are in zero pain! And chances are, you are already a Wind River customer (your relationship manager says hello by the way)!

If you answer “yes” to all of the questions above – congratulations, you are in zero pain! And chances are, you are already a Wind River customer (your relationship manager says hello by the way)!

![]() If you answer “no” to only one question, your pain may not be that bad yet, but keep a close eye on it. It can rapidly progress if left unmonitored.

If you answer “no” to only one question, your pain may not be that bad yet, but keep a close eye on it. It can rapidly progress if left unmonitored.

![]() If you answer “no” to two of the questions, you’re being taken for granted and should explore alternative providers very soon.

If you answer “no” to two of the questions, you’re being taken for granted and should explore alternative providers very soon.

![]() If you answer “no” to all three questions, your pain will not go away on its own, and immediate treatment is recommended. Your payment relationship is unhealthy and, if left untreated, can cause even greater pain for you in the near future.

If you answer “no” to all three questions, your pain will not go away on its own, and immediate treatment is recommended. Your payment relationship is unhealthy and, if left untreated, can cause even greater pain for you in the near future.

Payments are such an important part of your operation. You need and deserve to partner with a processor that recognizes this and is committed to delivering exceptional service to your business – not occasionally but every time you need. Don’t ever accept anything less – not from us or from anyone else.

Coming in part three of our health assessment, I’ll focus on the security of your environment.