How to Win the Integrated Payments Game

Do you remember playing “The Game of Life” as a kid? It’s a board game that depicts a person’s experiences as he or she travels though different stages of life. You start by choosing your initial life path – College or Career – then with the spin of a spinner, your game piece may land on a space that gets you married, earns you a million dollars, gives you twins, makes you bankrupt, etc.

Although there are decision points along the way, you can’t go back to choose a different life path. You’re pretty much stuck with wherever the spinner number takes you. There are a few different end-points to the game, one of which was Millionaire Estates. Most of us wanted to land there.

Choosing Your Path: The Downside of the Using Multiple Payment Partners

Parallels to Integrated Payments

We can draw a couple of parallels when it comes to integrating payments in your software:

- Your decision of which path to pursue in the beginning – multiple payment provider environment or preferred payment provider environment – has a direct impact on your experience

- Most of us would like to end up at Millionaire Estates

That’s where the parallels pretty much end. Unlike the board game Life, your specific experience isn’t tied to a number on the spinner or the roll of dice. If you don’t like the space you’ve landed on, don’t stay there. You have complete control to jump off your current path and pursue an alternative.

Playing the Integrated Payments Game in Real Life

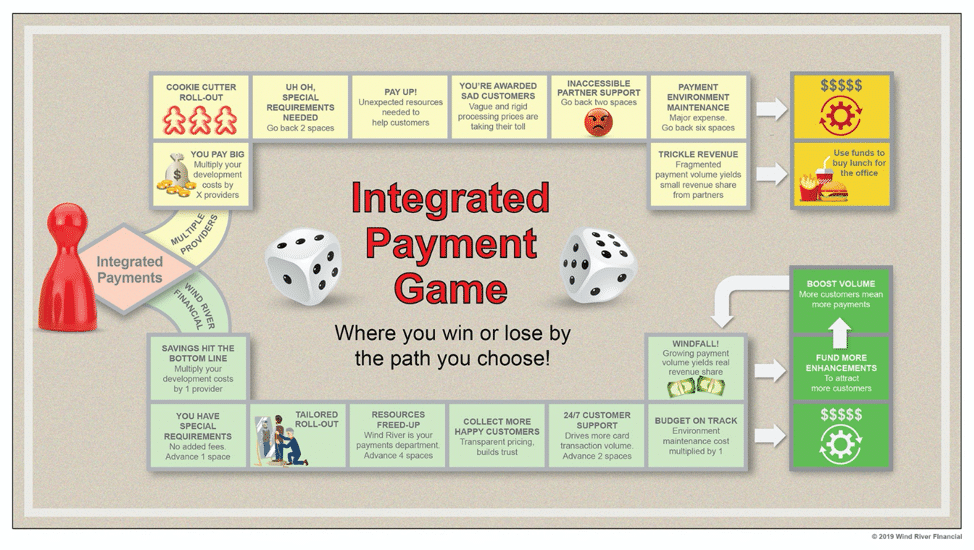

Recently, Wind River created an Integrated Payments Game, its own version of The Game of Life, where you move along to different experiences on your chosen path. While it was meant to be a fun visual, it is realistic and is based on actual stories that different software providers have shared with us.

I’d like to expound upon the different integrated payment experiences over the course of the next few blog posts. Today, we’ll start at the beginning – making that initial decision.

Choosing Your Initial Path Wisely

When playing the Life board game, you can see the specific experiences that lay ahead on each path, so making that initial choice becomes much easier. The same concept applies with the Integrated Payments Game. Using our game board, you can get a glimpse of what experiences may lie ahead for you on a given path. It just might make your initial decision a little easier.

If You Choose the Multiple Payment Provider Path

Giving customers the option of choosing whichever payment provider they want always sounds like a good idea. It may appear to be the most customer-friendly thing to do. The reality is that it often ends up as a disservice to customers from a pricing perspective and a support perspective. You won’t have any control of either, yet a negative customer payments experience will reflect poorly on you and your software.

Costly to Develop

In addition to having no control of your customers’ pricing and service experience, costs to you can quickly mount. Whatever your internal development costs are for integration, multiply that amount by the number of providers you will support through your platform. You’ll want to grab a calculator as the amount gets pretty big, really fast. Conversely, if you multiply your development costs by a single, preferred provider, they become much more manageable.

In addition to having no control of your customers’ pricing and service experience, costs to you can quickly mount. Whatever your internal development costs are for integration, multiply that amount by the number of providers you will support through your platform. You’ll want to grab a calculator as the amount gets pretty big, really fast. Conversely, if you multiply your development costs by a single, preferred provider, they become much more manageable.

Cookie Cutter Capabilities

Looking ahead on the multiple provider path, your next stop will be to roll-out a cookie-cutter payment solution. If cookie cutter is all your customers require, that’s fine. But what if your customers have special payment requirements that are not a part of their chosen provider’s general solution? Often just one special requirement can mean big customization fees that you may or may not be able to pass along.

Looking ahead on the multiple provider path, your next stop will be to roll-out a cookie-cutter payment solution. If cookie cutter is all your customers require, that’s fine. But what if your customers have special payment requirements that are not a part of their chosen provider’s general solution? Often just one special requirement can mean big customization fees that you may or may not be able to pass along.

Time and again we find that attempting to wedge customers’ needs into a provider’s cookie cutter mold leaves many needs unmet and just sitting on the table.

The way to deliver the optimal payment solution to your customers is to partner with a provider that will mold the solution to fit their needs – without tacking on a bunch of pricey customization charges. The last part of that sentence is key. You can have any capability you want with pretty much any provider you want, it’s all a matter of whether you have to pay hefty fees to get it.

Taking Charge of Your Costs

Look ahead on the Integrated Payments Game board, and you’ll see the costs of supporting a multiple provider environment continuing to accumulate. The good news is if you find yourself on a path that is mired with cost after cost, it’s not too late to make the leap to the alternative. We’ve been working with many software companies lately that have found they could no longer afford to support a multi-provider environment and are making the move.

Or, you may choose to stay where you are and roll the dice on expenses. But I’m pretty sure the priciest path won’t lead to Millionaire Estates any time soon.

The High Cost of Poor Customer Experience

Relinquishing Control

Giving your customers their choice of payment processing partners may seem like a good idea, but upon closer examination, it can be a perilous journey fraught with potholes, pitfalls, and problems at every turn. Problems that can result in losing the very customers you are trying to please.

The issue is that not every payment processing partner is as committed to delivering the same level of quality customer care that you provide. And when you integrate with them, you essentially relinquish all control over your customers’ encounters with them.

Examples of poor experiences include:

- Inconsistent, misleading or vague pricing

- Hidden fees on customer invoices

- Difficulty contacting a service representative

- Slow issue resolution and response times

- Lackadaisical approach to security and compliance

Take each one of these examples and multiply it by the number of payment processors you support on your platform, and you have exponentially increased the risk of a poor customer experience. Bad experiences – even a single bad experience – puts your customer relationships in jeopardy and can tarnish your reputation.

Regaining Control

There is always a degree of risk whenever you integrate with external vendors. While you can’t completely control your customers’ experience with those vendors, you can mitigate the risk by carefully vetting your payment partners. Here’s a list of desirable partner attributes:

1. Transparent Pricing

Be leery of payment processing partners that promise your customers super low rates or bundled and flat rate plans. Remember, they need to make their money somehow, and many times it is in the form of unnecessary costs hidden on your customers’ bills and “rate creep” throughout the contract term.

Make sure your payment partner(s) is completely transparent with fees and that every line on a customer’s invoice is clear and understandable.

If you’re not sure whether your payment processing partners are transparent, just ask your customers two questions:

Do you understand what you pay for credit / debit processing, and what you get for it?

Has your pricing remained the same since you signed with your provider?

If your customers don’t understand their credit and debit processing costs or their pricing has changed, they’re in the middle of a bad experience. It may only be a matter of time before that experience reflects on you.

2. Service Commitment

This can be a little tricky. Companies tend to not create marketing campaigns that promote their irresponsible and inconsistent customer service. Since poor service is not advertised, you’ll need to flip the approach and look for signs of a positive commitment to service within your payment processors. These indicators include:

- Dedicated account or service rep

- Regularly scheduled account reviews with customers

- High customer retention rate

- High Net Promoter Score (NPS) of 30 or higher

- 24/7 service and support phone number

To ensure the best experience possible, make sure your processing partner(s) don’t just say they care about servicing customers, they actually demonstrate it – 24 hours a day, 7 days a week. Put them to the test. Check their customer retention, contract renewals, and customer satisfaction scores. These are your customers, your lifeblood and your reputation. Don’t place them in the hands of just anyone.

3. Security Minded

Nothing screams poor customer experience like a data breach. They are costly to remedy and can seriously impair the trust your customers have built with their own consumers. Security should be top of mind when assessing your payment processing partners – particularly if your customers are small to medium size businesses.

According to an article last month in TechRepublic, more than 3,800 data breaches have hit organizations so far in 2019. This is an increase of 54% over the last four years. Another unsettling trend is that small businesses continue to be primary targets – currently experiencing 43% of all cyberattacks.

Service-focused payment processors will help your customers:

- Comply with payment card industry data security standards (i.e. PCI)

- Create a risk management strategy to handle chargebacks and fraudulent transactions

- Mitigate financial risk with breach protection insurance for their business

If your customers’ payment processor hasn’t talked to them about security this year, your customers are at risk. The threats from cybercriminals are dynamic, and the security measures that your payment processing partners engage with your customers need to be just as dynamic.

Which Would You Choose?

In the Integrated Payments Game, the service your customers receive often depends largely on which initial route you choose. The choice is yours.

Carefully Chosen Payment Partner Route

Multiple Payment Partners Route

The Effect of Multiple Providers on Payment Revenue

If you look at the actual Game of Life board, you will see that players end up in one of two places – Countryside Acres (retirement village) or Millionaire Estates (a greatly desired location for retirement.)

If you look at the actual Game of Life board, you will see that players end up in one of two places – Countryside Acres (retirement village) or Millionaire Estates (a greatly desired location for retirement.)

With integrated payments, the destinations are much more polarized. Depending on the path you choose, you may enjoy steady windfalls of revenue or be forced to settle for a few sprinkles, if any at all.

Why the Disparity in Revenue?

It all comes down to math. If you have a preferred partner that shares revenue, simply multiply the number of basis points they share by the total transaction volume going through your platform. Depending on the number of customers running card payments, your share of revenue can get pretty large, pretty quickly. Maybe even Millionaire Estates large.

Aside from your receiving more revenue, your customers also benefit from your preferred partner relationship. Think about volume discounts. Running the transactions of all your customers through that single partner leverages their aggregate volume, which provides better processing rates for them. This approach will also have a lasting impact on customer satisfaction, which affects retention and loyalty.

On the flip side, let’s say you’re integrated with five payment partners but only one of them shares revenue with you. For simplicity and easier math, we’ll assume all transaction quantities are fairly equal across the five processors. This means you’re getting compensated on only 20% of your volume – not a very desirable or profitable outcome.

The bottom line is: If you are enabling card payments through your platform, you should be receiving compensation for every transaction, not just a handful.

What Would You Do With the Extra Funds?

Having a steady source of payment revenue gives you flexibility to fund a multitude of initiatives. Many Wind River customers use their residual income to support development projects to enhance features and functionality. One customer actually recouped all its costs for a major platform project. Others hire additional staff. And still others choose to implement internal training and education programs. It doesn’t really matter. The point is that you have extra money to do with whatever you want.

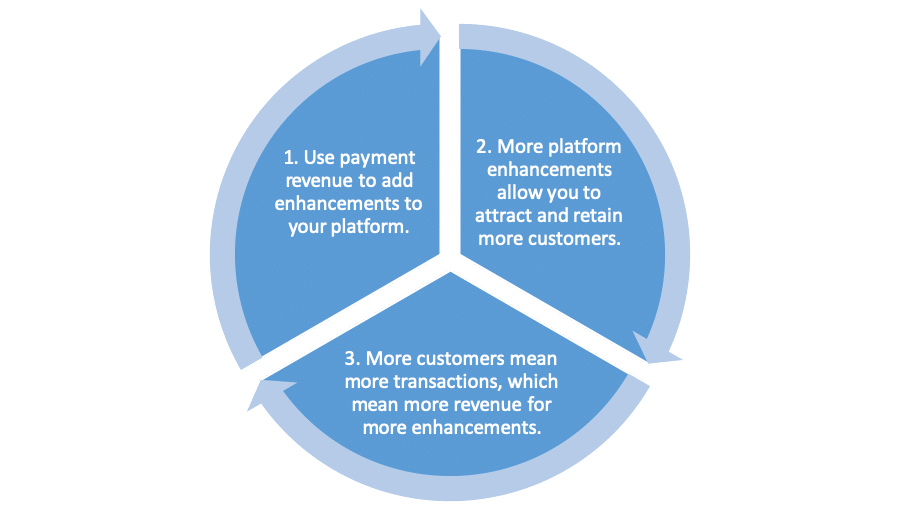

My personal favorite is reinvesting in the business through development projects as it can start a perpetual cycle of growth. Here’s what I mean:

Which Path are You On?

If you find yourself venturing down a path that leads to windfalls of payment revenue, good for you. Keep going – the road is smooth and the sky is sunny.

But if your path has you supporting costly integrations with multiple processors while reaping limited payment revenue, time to take the exit ramp.

Rerouting to a Better Path

Exiting the Road You’re on

If you’re currently supporting multiple payment integrations, you may think backtracking your path, undoing existing vendor relationships, and starting all over again with a single provider is a long, drawn-out journey. In reality, it can be quite the opposite. Depending on your payment partner, it can be just a quick trip down the road. Maybe even just a few blocks.

Identifying the Right Integrated Payment Partner

There are many landmarks that can guide you on your journey to selecting a preferred payment partner. It’s important to look for these signs because if you don’t see them, you may not be selecting the optimal partner, and you can find yourself looking for another exit ramp in the near future.

Below is a list of questions to consider as you navigate toward choosing a preferred payment partner.

![]() Does the provider support a payment gateway(s) that you have already integrated within your software?

Does the provider support a payment gateway(s) that you have already integrated within your software?

If so, it is very likely that no new development will be necessary, which is great news for you and your customers.

![]() Is the provider offering to work with you on a payment strategy?

Is the provider offering to work with you on a payment strategy?

You wouldn’t go to market without a firm product strategy in place for your software, so why would you move forward with payments without creating a solid strategy? Your core competency is your software, not necessarily payments. Having a payments partner that will leverage its expertise to work with you on creating your payment strategy sets you on a path to greater success.

![]() Does the provider create synergies that lead to payment revenue opportunities?

Does the provider create synergies that lead to payment revenue opportunities?

If they do not, immediately remove them from your list. Enabling payments through your software should always lead to added revenue. Do not accept anything less.

![]() Does the provider true act like your Payments Department?

Does the provider true act like your Payments Department?

Payments are the lifeblood of your customers so you need to make sure support is available any time any payment related question or issue arises – 24/7. Check the provider’s customer retention rate. It should be greater than 90%. Also check their Net Promoter Score (NPS). It should be 30 or higher. If they don’t have one or don’t even know what NPS is, move on.

![]() Does the provider offer a proof of concept to demonstrate its value?

Does the provider offer a proof of concept to demonstrate its value?

A good payment partner understands there may be a little trepidation about transitioning to a single provider. The best way to overcome that anxiety is to prove their worth to you with a small sample set of customers.

Optimal time to transition your customers

I have found that announcing to customers that you are making the transition to a new, preferred payment partner is often well received when bundled with other software enhancements such as: a new release, platform upgrades, moving from on premise to SaaS, or as a complement to new features that you’re launching.

That said, if you’re on a knobby payments path, the sooner you get off that road, the better for your business and your customers’ business. It’s never too late to take that exit ramp.