In Brief: Most assuredly, monetizing integrated payments is a smart move. Short-sightedness comes into play when monetization, in and of itself, IS the strategy. The focus at that point becomes revenue and the ability to drive as much as possible from the payment integration. There is a bigger picture, though. One that can have a far greater impact on the revenue growth of SaaS providers. This article provides details on that bigger picture strategy.

If you Google the words “payment monetization,” you will get pages and pages of articles (many of which are sponsored ads from payment processors) on how SaaS providers can monetize their payments functionality. Some offer eight tips. Some provide five steps to consider. Others go beyond simple monetization and supply a list of features you can mark up even higher.

Sounds like a great plan. After all, who doesn’t want more revenue? But did you know that payment monetization alone is a short-sighted strategy that actually may end up costing you money in the long run. If you’re a SaaS provider with embedded payments or are considering adding payment functionality, this article is for you. Read on.

Popular Payment Monetization Model

The usual payment monetization model centers on revenue share from the integrated payment provider. They pay you for every payment that is processed through your software. The higher the percentage of revenue shared, the more revenue hitting your bottom line. As a result, many SaaS providers choose an integrated payment provider that offers the highest share percentage. This can be as much as 80 percent — sometimes even more, depending on payment volume. The earning potential makes these payment monetization models super attractive and hard to resist.

Revenue share percentages of this magnitude make it easy to overlook one missing component. Payment providers will NOT settle for a smaller slice of the revenue pie just to give you a larger piece. It is simply not in their DNA – particularly if your payment provider must worry about Wall Street and shareholder value. That means the money has to come from somewhere. And by somewhere, I mean your customers. It comes in the form of higher prices, added fees, and reduced customer support and service.

How Your Revenue Share Affects Your Customers’ Experience

Customers are often charged higher payment processing fees and face regular price increases in many payment monetization models. Consider this quote from the Fiserv CFO when discussing how his company jumped on the inflation price hike bandwagon and raised its own prices. It appears in a recent Payments Dive article about a potential Global Payments price increase.

“We saw a price increase opportunity last year, largely in line with the rest of the world,” Fiserv CFO Bob Hau said.

Side note: Fiserv’s revenue grew 9 percent last year over 2021, according to the Payment Dive article. Also noteworthy is that the CFO did not respond to a question about the price hike’s impact on customer attrition. The lack of a response is telling. Arbitrarily raising prices without adding value has a negative effect on the customer experience, and negative customer experiences lead to customer attrition.

A recent statement analysis Wind River prepared for a merchant using the payment integration of its software provider revealed significantly higher fees – much higher than if the merchant processed payments outside the software. Granted, there is a convenience to integrated payments that customers should pay for. It’s when those fees get excessive that customer retention is at greater risk.

The Bigger Picture

Consider your payment integration beyond its ability to create revenue and look at it as a means for enhancing the customer experience. If you agree that a poor customer experience jeopardizes their retention, then it’s reasonable to assume an enriched experience leads to greater customer retention. Customer acquisition tends to become easier as well.

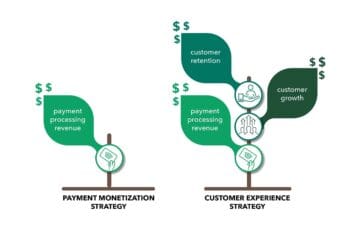

A customer experience strategy drives revenue from more places than a singular payment monetization strategy. Here’s how. Payment monetization delivers revenue from one source, payments. And that can be significant, unless your universe of customers using payments starts to shrink. Then it’s not so great.

Conversely, focusing on the customer experience delivers revenue from three sources: customer acquisition, customer retention, and revenue share from payments processed through your platform. That too can be a significant number that keeps getting larger as your customer base grows.

Enhancing the Customer Experience

There are four key customer needs that, when met, deliver an enhanced payments experience.

1) Ample Technology: The payment tech has to meet the needs of your customers’ business. That includes the payment types and payment channels their consumers prefer. Examples are card present transactions, card-not-present, ecommerce, mobile payments, text-to-pay, autopay, ACH, etc.

2) Access to Timely Service: Fewer things are more frustrating than not being able to talk to a customer service rep when you need immediate support. Ongoing cost savings measures by many payment providers continue to have a ripple effect on the timeliness of the service they deliver to your customers.

3) Fair Pricing: Your customers don’t want to feel taken advantage of or price gauged. You probably don’t want that either. Customers want fair pricing that remains fair. No hidden fees or unnecessary charges.

4) Help with Security: Things like fraud protection and PCI compliance can be overwhelming to your customers. The more straightforward those processes are, the better the customer experience.

Related article: Five Things to Look for in an Integrated Payment Partner

“Revenue Share is Not Our North Star”

This is a quote that the owner of a SaaS company shared with me a few days ago. He went on to explain that he does not make balance sheet decisions that are not focused on the customer. His philosophy pretty much sums up the point of this article. Many times, payment monetization strategies focus so much on the revenue part that they entirely skip over the customer part.

In Summary

Undoubtedly monetization is important. Revenue is the lifeblood of any business and opportunities to grow that revenue should be considered. That said, a payment monetization strategy alone will grow your revenue from customer payment processing. A customer experience strategy will grow revenue in three areas rather than just one: gaining customers, keeping customers, and payment processing. Which strategy works best for your business?